Home / News & Blog / Abrasive Blog / Abrasives and Grinding Tools Market Size and Development Trend

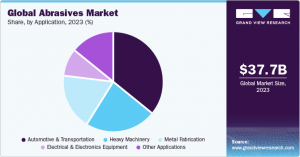

The global abrasives market was valued at $37.71 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.0% from 2024 to 2030. The growth of the metalworking industry is one of the major drivers, fueled by increased demand for prefabricated buildings and components, as well as the expansion of manufacturing. The growth of the metalworking industry is also supported by rising demand from various end-use industries, including automotive, aerospace, agriculture, and healthcare. Due to technological advancements and a shortage of skilled labor, the abrasives market is continuously evolving.

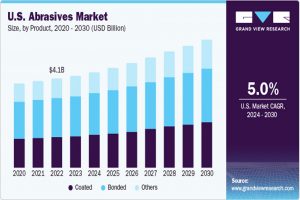

Estimated size and growth rate of the abrasives and grinding tools market in the United States (2024-2030)

The United States holds a significant position in the global market. Despite the lack of significant growth in the manufacturing sector, primarily due to changes in economic priorities affecting tariffs and domestic investment, the emphasis on domestic production is expected to bring substantial results for market growth.

The growth of the electric vehicle (EV) industry is expected to be another driving factor for the abrasives market. For example, in January 2024, Vietnamese electric vehicle manufacturer VinFast Auto announced plans to invest $2 billion in building a comprehensive EV manufacturing plant in Tamil Nadu, India. The demand for electric vehicles and charging stations in Asia is increasing, and it is expected to boost the consumption of abrasives and abrasive tools in the coming years.

In addition, the growth of manufacturing in developing economies in Asia is driving the demand for super abrasives. For example, in December 2023, the Asian Development Bank (ADB) announced plans to invest $250 million into India’s industrial sector to develop manufacturing, and supply chains, and promote the growth of regional and global value chains. This loan is part of the financial support aligned with India’s National Industrial Corridor Development Program (NICDP) initiative. Such initiatives are driving industrial growth in the country, thereby fostering market growth.

However, the instability of raw material prices is expected to limit the growth of the abrasives market. The mass production of abrasives and abrasive tools requires large quantities of raw materials. Due to the impact of energy price fluctuations on transportation costs, the prices of bauxite and other minerals are highly volatile, which in turn affects the production costs and pricing of abrasives and abrasive tools.

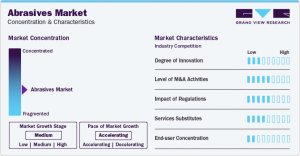

Market Concentration and Characteristics

The market growth stage is mid-term, with the growth rate accelerating. Due to the increased demand for prefabricated metal products, the market is expected to experience strong growth. Companies are investing in research and development and innovation to launch high-performance, long-lasting, and sustainable abrasives and abrasive tools. Innovative eco-friendly and smart abrasive technologies are focusing on meeting evolving customer demands, improving operational efficiency, and reducing environmental impact.

Moderate merger and acquisition activity and the expansion of manufacturing facilities by leading industry players are also characteristics of the market. Strategic initiatives are part of market consolidation efforts, helping to expand product portfolios, global presence, technological advancements, enter new markets, and achieve economies of scale.

The market is also influenced by the concentration of diverse end-user industries. Its performance is affected by trends and economic cycles in various end-user sectors, such as construction, electronics, automotive, metalworking, and medical devices. Companies with a broader customer base can manage market fluctuations in specific sectors. The market is also impacted by regulatory frameworks related to health, environment, and safety issues. It is influenced by regulations regarding disposal practices, raw materials, carbon emissions, and manufacturing processes. Abrasive products face intense competition from alternative technologies and services, such as water jet cutting, laser cutting, and other non-abrasive methods. Therefore, investment in research and development is crucial for the continued growth of the market and for ensuring that abrasive products remain competitive in the face of alternatives.

Product Insights

In 2023, bonded abrasives accounted for the largest revenue share, exceeding 43.0%. Bonded abrasives, including mounted wheels, grinding wheels, and abrasive wheels, are used in precision and rough grinding applications due to their efficiency and enhanced operational capabilities.

Coated abrasives are expected to grow at the fastest compound annual growth rate (CAGR) from 2024 to 2030. These abrasives include disc, belt, disc, roll, and flap wheel products. The increasing demand for such product types is driving companies to expand their production capacities. For example, in August 2023, VSM Abrasives, a leading German manufacturer of coated abrasives for metal and wood, celebrated the expansion of its existing manufacturing facility, with the new plant covering 50,000 square feet.

Coated abrasives are used in appliances, sanitary ware, furniture, automotive, processing, construction, and automotive parts. The growth of the stainless steel processing and woodworking industries is also expected to drive the growth of this segment.

Application Insights

In 2023, the automotive and transportation segment accounted for the largest revenue share, exceeding 35.0%. In the automotive industry, abrasives are used for various applications, such as rough grinding and paint finishing. Additionally, diamond grinding wheels are the preferred choice for grinding and polishing automotive parts to improve surface finish.

Global Abrasives Market Share and Size – 2023

Heavy machinery is one of the fastest-growing application segments in the market. Abrasives are used for cutting metals, grinding, and crushing mining equipment, among other applications. The growth of manufacturing in developing countries is expected to drive the demand for heavy machinery, thereby promoting the consumption of abrasives.

For example, in April 2022, Hitachi Construction Machinery Co., Ltd. announced the expansion of its manufacturing facilities for small products, such as compact wheel loaders and mini excavators. Production capacity is expected to increase by 30% by 2025. Demand for equipment and machinery is rising in North America and Europe. Such investments are expected to increase the supply of machinery and equipment in the coming years, thereby benefiting market growth.

Electrical and electronic equipment is another lucrative market segment, where abrasives are used to cut and grind various hard materials such as silicon, glass, quartz, and zirconia used in the production of circuit components and optical discs. The growth of the electrical and electronic manufacturing industry in various developing and developed countries due to the increase in global business demand is expected to benefit the abrasives market.

Regional Insights

In 2023, the Asia-Pacific dominated the market, accounting for over 55.0% of the revenue share. Infrastructure development, increased manufacturing investments, and the growth of electric vehicle production in developing countries are expected to drive this growth. Southeast Asian countries are a potential market for abrasives and abrasive tools. For example, according to data from the General Statistics Office of Vietnam, the industrial production index grew by 5.8% in 2023 compared to 2022. The growth of the manufacturing and processing industries is a key driver of industrial sector expansion. The development of the country’s manufacturing sector has increased the demand for machinery and products.

Abrasives Market Trends, By Region, 2024-2030

North America is expected to experience steady growth from 2024 to 2030, driven by increased demand from the automotive, aerospace, and defense industries. Growth has slowed due to the impact of the COVID-19 pandemic in 2020 and concerns over economic recessions. However, the region’s emphasis on electric vehicle production and the recovery of the aircraft manufacturing business is expected to impact market growth during the forecast period positively.

The growth of North America’s metalworking and machining industries is also expected to provide favorable growth opportunities for manufacturers. For example, in November 2023, Klöckner & Co. announced the acquisition of a U.S. metal processing company, Industrial Manufacturing Services (IMS). This strategic transaction is part of vertical integration and the expansion of its processing business portfolio, aimed at addressing the growing demand for processing services. Such investments are expected to drive product demand in the region.