Home / News & Blog / Abrasive Blog / Bauxite: Severe Spot Supply Situation and Multiple Positive Factors Stimulate Price Increase

1. Price Overview

Due to the prolonged shortage of domestic ore supply in the market and the continuous upward trend in downstream alumina prices, favorable factors continue to drive price increases. As a result, the average quoted price for domestic ore has reached a new high. As of November 8, 2024, the average untaxed price of China’s domestic bauxite has risen to 593.5 yuan/ton, marking an increase of 126.8 yuan/ton or 26.17% compared to the beginning of the year, and a rise of 140.6 yuan/ton or 31.04% compared to the same period in 2023.

The operating capacity of downstream alumina enterprises continues to increase, while the supply of domestic ore remains insufficient, leading to a rising reliance on imported ore. Occasional unexpected disruptions in overseas ore supply, coupled with the price correlation between imported and domestic ore, have driven continuous adjustments in the spot prices of imported ore. As of November 8, 2024, the quoted price (including current spot execution prices) for mainstream Guinean ore with 45% aluminum and 3% silicon content in China ranges from $80 to $88 per ton.

2. Current Status of Ore Supply

Domestic Ore: Inland mines remain constrained by policy regulations, with no significant improvement in production levels. The supply shortage shows no clear signs of easing, and mining operation rates in Shanxi and Henan provinces remain low, resulting in limited market spot availability. While mining activity in southern regions is better than in the north, the impact of normalized policy controls has become more pronounced compared to previous years, leading to a generally tight supply situation.

Imported Ore: Issues regarding shipping restrictions at certain mining companies in Guinea are still in the process of being resolved. Additionally, although the rainy season in Guinea has ended, some mining companies are facing constraints due to port operating conditions and road transportation, preventing shipment levels from fully recovering. As a result, despite an increase in ore supply from Guinea in 2024, the actual increase has fallen short of expectations. Combined with the shift in ore usage and the addition of new capacity at China’s alumina enterprises, the increased supply is insufficient to meet demand. Consequently, China’s imported ore supply remains tight in 2024.

3. Availability

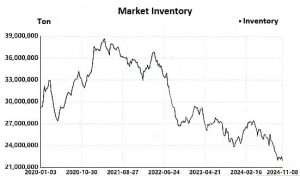

According to the latest statistics, as of November 8, 2024, the immediate bauxite inventory at Chinese ports stands at approximately 21.93 million tons, dropping below 22 million tons and setting a new five-year low in port inventory levels.

The factors contributing to the continuous decline in inventory are as follows:

1. According to historical patterns and considering shipping schedules, the impact of Guinea’s rainy season on ore supply is typically reflected in the middle to early part of the fourth quarter. This results in reduced port arrivals, while outbound transportation remains at normal levels, ultimately leading to a decline in port inventory.

2. Considering the steady increase in demand for imported ore by domestic alumina enterprises, coupled with the lower-than-expected release of additional overseas ore supply, alumina enterprises have been drawing on port ore inventories, leading to a reduction in immediate port inventory levels.

4. Market Outlook

The introduction of the northern heating season policy in the fourth quarter and the change in winter snow and temperature weather conditions will have an impact on mining and transportation in Shanxi and Henan, which may lead to a further tightening of domestic ore supply;

Some mining companies in Guinea are restricted in production due to policy factors. The subsequent negotiation and settlement work and the release of new production capacity will increase the supply of imported ore in China. However, considering the preparation of winter ore and the preparation of new alumina production capacity projects, there is still room for further increases in demand for imported ore.

It is expected that the price trend of downstream alumina will remain strong in the short term, which will continue to have a positive effect on ore prices.

In general, the later development of the above factors will have a mostly positive impact on ore prices, and China’s ore prices are still expected to rise in the short term.