Home / News & Blog / SiC, what is the demand?

Silicon carbide (SiC) has become an attractive semiconductor base material over the past few years due to its improved performance, especially in applications that require high power. Although SiC is now used in a variety of industrial equipment, most of the emerging demand will come from metal oxide semiconductor field effect transistor (MOSFET) applications in electric vehicle (EV) powertrains.

To gain deeper insights into trends in the SiC wafer market, we evaluated the key factors that may influence supply and demand. Compared to other forecasting methods, our approach features a significant distinction: a detailed examination of wafer production yield (the number of wafers meeting acceptable quality standards). Yield is often one of the most confidential metrics in the industry and can be challenging to compare across companies. As a result, most forecasts estimate supply based on nameplate capacity, which is the maximum theoretical output of a wafer fabrication facility.

Nameplate capacity does not account for yield losses or whether wafers meet specific quality grades. Therefore, production estimates based on nameplate capacity tend to overestimate supply in some of the most yield-sensitive segments. Automotive-grade MOSFET wafers, especially those for electric vehicles, have the lowest yields because they require complex manufacturing processes and must meet the most stringent quality standards.

Given the uncertainties around yield and other factors, we created multiple market scenarios for 2027, each incorporating different supply and demand inputs. These scenarios predict a wide range of outcomes, from an oversupply of SiC to balance and a supply shortage. While it is still too early to determine which scenario is most likely to occur, our analysis may help industry leaders better understand the key forces influencing the SiC market, particularly wafer yield.

Advantages and Challenges of SiC

Before diving into the market forces, it’s important to understand SiC’s inherent properties that give it several advantages over silicon, especially in power-hungry use cases such as electric vehicle inverters:

Higher efficiency. Lower energy losses, and lower thermal management costs due to the involvement of peripheral components.

Longer service life. Better thermal conductivity enables SiC chips to operate in a higher temperature range and withstand higher stress levels, thereby extending service life.

Smaller size. SiC can provide the same functionality as silicon in a smaller package with less semiconductor material, thereby reducing the number of semiconductors in high-power devices.

Simpler design. The higher power range allows for new designs at the system level, reducing passive components and contributing to long-term cost and waste reduction.

SiC wafers and the corresponding chips manufactured from them have a wide range of applications and can be classified into three basic grades. Diodes are built on the lowest-quality SiC wafers and serve the simplest function, allowing current to flow in one direction. MOSFETs are transistors that require higher-quality SiC wafers and are more complex, enabling current to switch directions. Automotive-grade MOSFETs demand wafers of the highest quality and transistors that meet strict specifications, requiring defect rates to be reduced to very low levels.

While industry-wide capacity expansion announcements suggest a significant increase in SiC wafer production capacity over the next five years, the exact mix and capabilities of this capacity remain unclear and may fall short of meeting the growing demand for electric vehicle applications.

Automotive-grade MOSFET wafers are the most challenging to produce and the most in-demand, making them particularly likely to be in short supply. Worse still, companies do not disclose the share of production allocated to automotive-grade MOSFET wafers, making it impossible to accurately estimate future supply. The only certainty is that the number of automotive-grade MOSFET wafers will be significantly lower than the capacity figures reported by manufacturers.

The slowdown in the electric vehicle market reveals new trends in SiC demand.

SiC is particularly important for the battery electric vehicle (BEV) industry, as it significantly enhances performance compared to silicon by extending driving range, reducing charging time, and decreasing the number of semiconductors in the vehicle.

While most BEV powertrains still use silicon solutions, OEMs are transitioning to dedicated SiC devices in second and third-generation vehicles, some of which have 800-volt systems. Due to the high power requirements of these BEVs, SiC offers benefits over silicon. By 2027, more than 50% of BEVs could rely on SiC powertrains, up from about 30% today. This shift, coupled with the growing preference of EV buyers for BEVs, will increase demand for SiC.

By 2027, more than 50% of battery electric vehicles (BEVs) are likely to rely on silicon carbide (SiC) powertrains, up from about 30% today. This shift, coupled with EV buyers’ growing preference for BEVs, will increase demand for SiC.

Changes in pure electric vehicle production

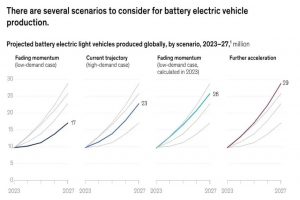

Although the growth rate of demand for electric vehicles has slowed down, the exact impact is difficult to predict due to the many factors influencing OEM manufacturing decisions. The McKinsey Center for Future Mobility (MCFM) acknowledges this uncertainty and has created different electric vehicle growth scenarios based on various assumptions regarding regulations, technology, raw material availability, and consumer behavior. The three MCFM scenarios we considered in our analysis are as follows:

Momentum Weakens. In this scenario, the reduction in electric vehicle costs is lower than expected, consumer demand decreases, vehicle range is limited, and regulations do not strongly drive the transition from internal combustion engine (ICE) vehicles.

Current Trajectory. This scenario assumes that the latest demand curves, production capacities, and electric vehicle regulations will continue to persist.

Further acceleration. Demand in this scenario would far exceed the current trajectory due to favorable policies, lower prices, increased raw material supply, increased vehicle production, and increased consumer interest.

The most optimistic acceleration scenario assumes that demand will exceed the current trajectory. If realized, by 2027, there will be 29 million battery-electric vehicles on the road (Figure 1). This is much higher than the forecasted 23 million vehicles in the current trajectory scenario and 17 million vehicles in the momentum-weakening scenario.

Figure 1:

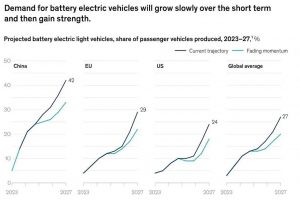

For passenger cars, MCFM’s estimates for BEV production in all major markets in 2024 are lower than the estimates for 2023, mainly due to potential declines in consumer interest, high car prices, and reduced incentives for purchasing electric vehicles in the EU and the US. China, the world’s largest electric vehicle market, is expected to see a slight decrease in passenger-car BEV production. Figure 2 shows the expected production in the current trajectory and momentum weakening scenarios.

Figure 2:

Overall, if the current growth trajectory continues, battery-electric vehicles are expected to account for about 27% of global passenger car production by 2027. However, regional differences will be significant. For example, battery electric vehicles may make up 42% of passenger car production in China, while the proportion in the US could be 24%. This pattern is consistent with the situation in recent years when China was also the largest producer of electric vehicles.

Different forecasts for the total demand for SiC.

In our analysis, we kept the future non-automotive SiC demand unchanged but considered different possibilities for automotive SiC demand based on MCFM’s estimates for BEV production in 2027.

Under MCFM’s Declining Momentum Scenario, demand for 150 millimeter (mm) equivalent SiC wafers is forecast to reach 3.7 million units in 2027. This is significantly lower than the SiC wafer demand estimates for the Current Trajectory Scenario (4.7 million units) and the Further Acceleration Scenario (5.7 million units).

The high defect rates and lower yields make supply estimates more complex.

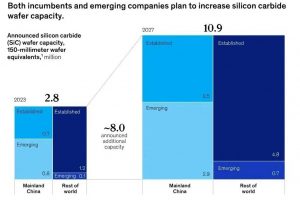

In recent years, the enthusiasm for electric vehicles has been so high that both new and existing SiC wafer suppliers have announced plans to increase their capacity for 150mm SiC wafer equivalents from 2.8 million wafers in 2023 to 10.9 million wafers in 2027, more than a threefold increase. However, it is important to note that this supply estimate does not account for yield losses.

When analyzing future supply announcements, we separately examined existing suppliers and emerging suppliers (Figure 3). Leading existing companies typically have a strong head start—about five to ten years of additional involvement in the SiC learning cycle—making them more likely to achieve higher yield performance. Existing companies produced approximately 1.9 million 150mm SiC wafer equivalents in 2023 and have announced plans to add around 5.4 million additional wafer equivalents by 2027.

Figure 3:

Emerging suppliers have not gone through as many learning cycles as existing suppliers. They have announced plans to expand their capacity from 900,000 150mm wafer equivalents in 2023 to approximately 3.6 million 150mm wafer equivalents by 2027. However, due to their lesser experience, the yield may be lower than that of existing suppliers.

Determining actual supply

As with demand, several factors could influence how supply changes, and whether companies meet or fall short of their announced targets. Therefore, we developed three different scenarios to estimate actual supply in 2027:

Commercialization. In this scenario, SiC suppliers will significantly improve wafer yields, reaching an average of 60% by 2027. This would be consistent with historical levels achieved by the industry’s top players and would supply 5.5 million wafers.

Announced capacity increases. This scenario assumes both existing and emerging manufacturers achieve their announced production targets and that yields remain consistent with current levels of approximately 48%. The wafer supply would be 4.7 million wafers.

Technology delays. This scenario assumes that established manufacturers achieve announced production targets while emerging manufacturers have difficulty significantly increasing production. The wafer supply is only 3.7 million pieces.

Taken together, these scenarios suggest that the supply of SiC wafers cannot be determined solely by demand levels; wafer supply is also a key factor. Additionally, the supply-demand imbalance may vary across different wafer grades. Since automotive MOSFETs have the highest demand but are also the most difficult to manufacture, this category is most likely to experience shortages, especially if semiconductor companies are unable to overcome current quality issues.

While there is still much uncertainty about the future direction, the SiC industry is actively responding to the new demands created by the growth of electric vehicles. Regardless of which scenario emerges, demand for SiC wafers will continue to grow and remain strong. At the same time, competition for technology, quality, and price leadership will intensify as wafer suppliers continue to invest heavily in improvements. Incumbents face competition from emerging companies and will benefit from ensuring that the shift to 200mm technology delivers the expected cost advantages to maintain their technology leadership. At the same time, emerging suppliers must focus on iterative learning to narrow the technology leadership gap with incumbents. The next few years will be a challenging but exciting period of opportunity for all industry stakeholders.